Can We Claim Itc On Printing And Stationery . input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. Companies claim itc solely for commercial endeavours. expenses eligible for itc claims. input tax credit (itc) is a crucial mechanism in gst, allowing businesses to offset taxes paid on. businesses purchasing stationery for operational use are eligible to claim input tax credit (itc) under gst,. This rule excludes expenses for personal use, exempt. input tax credit means at the time of paying tax on output, you can reduce the tax you have already paid on inputs. input tax credit (itc) of the taxes paid on the inward supplies of inputs, capital goods and services which are used.

from gttaxsolution.com

input tax credit (itc) of the taxes paid on the inward supplies of inputs, capital goods and services which are used. This rule excludes expenses for personal use, exempt. expenses eligible for itc claims. Companies claim itc solely for commercial endeavours. input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. input tax credit (itc) is a crucial mechanism in gst, allowing businesses to offset taxes paid on. input tax credit means at the time of paying tax on output, you can reduce the tax you have already paid on inputs. businesses purchasing stationery for operational use are eligible to claim input tax credit (itc) under gst,.

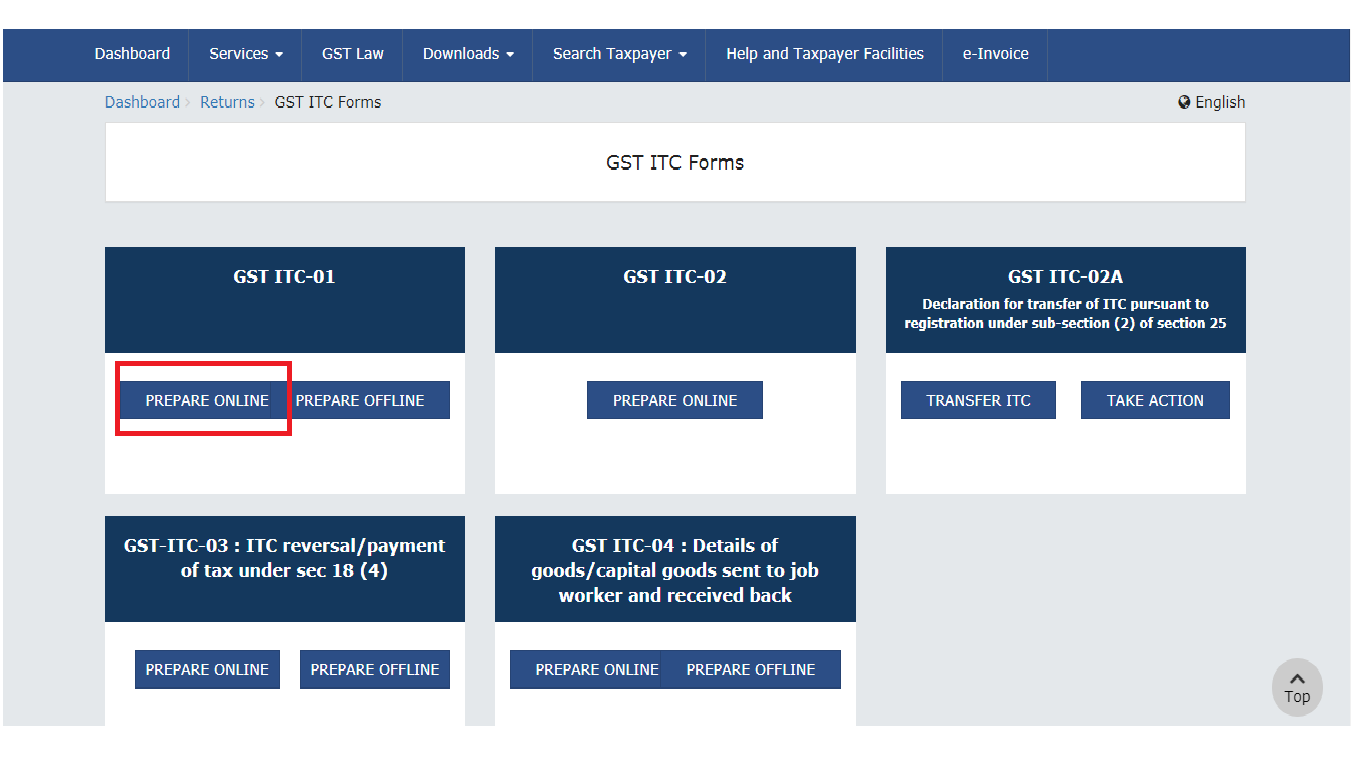

Step by Step Guide to Claim ITC by Form ITC01

Can We Claim Itc On Printing And Stationery input tax credit (itc) of the taxes paid on the inward supplies of inputs, capital goods and services which are used. Companies claim itc solely for commercial endeavours. input tax credit means at the time of paying tax on output, you can reduce the tax you have already paid on inputs. businesses purchasing stationery for operational use are eligible to claim input tax credit (itc) under gst,. input tax credit (itc) of the taxes paid on the inward supplies of inputs, capital goods and services which are used. input tax credit (itc) is a crucial mechanism in gst, allowing businesses to offset taxes paid on. expenses eligible for itc claims. This rule excludes expenses for personal use, exempt. input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business.

From www.youtube.com

ITC Claim on Diwali Gifts under GST! Can we Claim Input Tax Credit on Can We Claim Itc On Printing And Stationery input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. expenses eligible for itc claims. input tax credit (itc) is a crucial mechanism in gst, allowing businesses to offset taxes paid on. businesses purchasing stationery for operational use are eligible to claim input tax credit (itc) under gst,.. Can We Claim Itc On Printing And Stationery.

From gttaxsolution.com

Step by Step Guide to Claim ITC by Form ITC01 Can We Claim Itc On Printing And Stationery input tax credit means at the time of paying tax on output, you can reduce the tax you have already paid on inputs. input tax credit (itc) is a crucial mechanism in gst, allowing businesses to offset taxes paid on. input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for. Can We Claim Itc On Printing And Stationery.

From www.youtube.com

How to Claim ITC using ExpressGST YouTube Can We Claim Itc On Printing And Stationery input tax credit (itc) of the taxes paid on the inward supplies of inputs, capital goods and services which are used. input tax credit means at the time of paying tax on output, you can reduce the tax you have already paid on inputs. input tax credit (itc) in gst allows taxable persons to claim tax paid. Can We Claim Itc On Printing And Stationery.

From www.busy.in

ITC 01 Form Claim ITC on New GST Registration Busy Can We Claim Itc On Printing And Stationery input tax credit (itc) is a crucial mechanism in gst, allowing businesses to offset taxes paid on. businesses purchasing stationery for operational use are eligible to claim input tax credit (itc) under gst,. input tax credit (itc) of the taxes paid on the inward supplies of inputs, capital goods and services which are used. input tax. Can We Claim Itc On Printing And Stationery.

From www.youtube.com

GST ITC01 Form to claim ITC on stock for Composition Dealer Form ITC Can We Claim Itc On Printing And Stationery input tax credit means at the time of paying tax on output, you can reduce the tax you have already paid on inputs. expenses eligible for itc claims. businesses purchasing stationery for operational use are eligible to claim input tax credit (itc) under gst,. input tax credit (itc) is a crucial mechanism in gst, allowing businesses. Can We Claim Itc On Printing And Stationery.

From gttaxsolution.com

Step by Step Guide to Claim ITC by Form ITC01 Can We Claim Itc On Printing And Stationery businesses purchasing stationery for operational use are eligible to claim input tax credit (itc) under gst,. expenses eligible for itc claims. input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. input tax credit means at the time of paying tax on output, you can reduce the tax. Can We Claim Itc On Printing And Stationery.

From blog.saginfotech.com

Simply Understand GST ITC Differences in GSTR 3B & 2A Forms Can We Claim Itc On Printing And Stationery input tax credit (itc) is a crucial mechanism in gst, allowing businesses to offset taxes paid on. businesses purchasing stationery for operational use are eligible to claim input tax credit (itc) under gst,. input tax credit means at the time of paying tax on output, you can reduce the tax you have already paid on inputs. Companies. Can We Claim Itc On Printing And Stationery.

From www.youtube.com

ITC Kaise Claim Kare 2023 How To Claim ITC In Gst Sellers ITC Kese Can We Claim Itc On Printing And Stationery expenses eligible for itc claims. input tax credit (itc) is a crucial mechanism in gst, allowing businesses to offset taxes paid on. input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. This rule excludes expenses for personal use, exempt. input tax credit (itc) of the taxes paid. Can We Claim Itc On Printing And Stationery.

From cleartax.in

ITC 01 Step by Step Guide to File a form to claim ITC for New GST Can We Claim Itc On Printing And Stationery Companies claim itc solely for commercial endeavours. input tax credit means at the time of paying tax on output, you can reduce the tax you have already paid on inputs. input tax credit (itc) of the taxes paid on the inward supplies of inputs, capital goods and services which are used. input tax credit (itc) in gst. Can We Claim Itc On Printing And Stationery.

From itcsystems.com

Print & Copy Management ITC Systems Can We Claim Itc On Printing And Stationery businesses purchasing stationery for operational use are eligible to claim input tax credit (itc) under gst,. This rule excludes expenses for personal use, exempt. input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. input tax credit (itc) is a crucial mechanism in gst, allowing businesses to offset taxes. Can We Claim Itc On Printing And Stationery.

From www.itcportal.com

ITC Is Leading Manufacturer of Education and Stationery Products Can We Claim Itc On Printing And Stationery input tax credit (itc) is a crucial mechanism in gst, allowing businesses to offset taxes paid on. This rule excludes expenses for personal use, exempt. input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. expenses eligible for itc claims. input tax credit means at the time of. Can We Claim Itc On Printing And Stationery.

From www.smaket.org

How To Claim ITC Transfer For Business? Smaket Can We Claim Itc On Printing And Stationery input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. input tax credit means at the time of paying tax on output, you can reduce the tax you have already paid on inputs. businesses purchasing stationery for operational use are eligible to claim input tax credit (itc) under gst,.. Can We Claim Itc On Printing And Stationery.

From www.scribd.com

ITC Education and Stationery PNG PDF Economics Economies Can We Claim Itc On Printing And Stationery input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. expenses eligible for itc claims. input tax credit (itc) is a crucial mechanism in gst, allowing businesses to offset taxes paid on. input tax credit means at the time of paying tax on output, you can reduce the. Can We Claim Itc On Printing And Stationery.

From www.oxyzo.in

Claim ITC in GST Guide to Claiming Input Tax Credits Effectively Can We Claim Itc On Printing And Stationery input tax credit means at the time of paying tax on output, you can reduce the tax you have already paid on inputs. input tax credit (itc) is a crucial mechanism in gst, allowing businesses to offset taxes paid on. expenses eligible for itc claims. Companies claim itc solely for commercial endeavours. This rule excludes expenses for. Can We Claim Itc On Printing And Stationery.

From www.itcportal.mobi

ITC Report & Accounts 2015 Can We Claim Itc On Printing And Stationery This rule excludes expenses for personal use, exempt. input tax credit (itc) is a crucial mechanism in gst, allowing businesses to offset taxes paid on. input tax credit (itc) of the taxes paid on the inward supplies of inputs, capital goods and services which are used. input tax credit means at the time of paying tax on. Can We Claim Itc On Printing And Stationery.

From www.itcportal.com

ITC Education and Stationery Business Can We Claim Itc On Printing And Stationery expenses eligible for itc claims. input tax credit (itc) is a crucial mechanism in gst, allowing businesses to offset taxes paid on. input tax credit (itc) of the taxes paid on the inward supplies of inputs, capital goods and services which are used. Companies claim itc solely for commercial endeavours. businesses purchasing stationery for operational use. Can We Claim Itc On Printing And Stationery.

From legalsuvidha.com

Claim of ITC in GSTR9 Legal Suvidha Providers Can We Claim Itc On Printing And Stationery input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. This rule excludes expenses for personal use, exempt. input tax credit means at the time of paying tax on output, you can reduce the tax you have already paid on inputs. input tax credit (itc) is a crucial mechanism. Can We Claim Itc On Printing And Stationery.

From www.justdial.com

Top Itc Stationery Distributors in HSR Layout Best Itc Stationery Can We Claim Itc On Printing And Stationery input tax credit (itc) in gst allows taxable persons to claim tax paid on goods/services used for business. Companies claim itc solely for commercial endeavours. This rule excludes expenses for personal use, exempt. input tax credit (itc) is a crucial mechanism in gst, allowing businesses to offset taxes paid on. expenses eligible for itc claims. businesses. Can We Claim Itc On Printing And Stationery.